Transferring money internationally can be complex, but with the right knowledge and tools, it can be made easy and convenient. In this article, I will cover the different ways you can transfer money from Japan to India.

As per a report from Statista, there are approximately 2.76 million residents of foreign nationality were registered in Japan in 2021. This makes up about 2.2 percent of the population.

Popular Money Remittance Recipient Countries from Japan

Japan is a developed country that is known for its strong economy and high standard of living. As a result, there are many people who need to send and receive money internationally from Japan.

Because of the language gap, the Indian population is very small in Japan. As of 2020, there are only 37,933 Indians living in Japan, which makes up around 1% of the total foreign population in Japan.

Some of the most popular money transfer countries from Japan include:

- United States: The United States is a popular destination for money transfers from Japan. Many people in Japan have family or friends in the US, and there are also many Japanese businesses that have operations in the US.

- China: China is another popular destination for money transfers from Japan. There is a significant amount of trade and investment between the two countries, and many people in Japan have business or personal connections in China.

- Philippines: The Philippines is a popular destination for money transfers from Japan, particularly among Filipino workers who are based in Japan. Many of these workers send money back home to support their families.

- South Korea: South Korea is another popular destination for money transfers from Japan. There is a significant amount of trade and investment between the two countries, and many people in Japan have business or personal connections in South Korea.

- Vietnam: Vietnam is a popular destination for money transfers from Japan, particularly among Vietnamese workers who are based in Japan. Many of these workers send money back home to support their families.

- Thailand: Thailand is a popular destination for money transfers from Japan, particularly among Japanese tourists and expats who are based in Thailand. Many of these people send money back to Japan to support their families or pay bills.

- Indonesia: Indonesia is another popular destination for money transfers from Japan. There is a significant amount of trade and investment between the two countries, and many people in Japan have business or personal connections in Indonesia.

- Australia: Australia is a popular destination for money transfers from Japan, particularly among Japanese tourists and students who are based in Australia. Many of these people send money back to Japan to support their families or pay bills.

- Canada: Canada is another popular destination for money transfers from Japan. Many people in Japan have family or friends in Canada, and there are also many Japanese businesses that have operations in Canada.

- United Kingdom: The United Kingdom is a popular destination for money transfers from Japan, particularly among Japanese tourists and students who are based in the UK. Many of these people send money back to Japan to support their families or pay bills.

How to send money from Japan to India

Sending money from Japan to India can be done using several different methods, including bank transfers, online money transfer services, and money transfer agents. Here are the steps involved in sending money from Japan to India using these methods:

- Bank transfer: A bank transfer is a secure and reliable way to send money from Japan to India. To send a bank transfer, you will need to provide the following information to your bank:

- The recipient’s name and address

- The recipient’s bank account number and branch address

- The recipient’s bank’s SWIFT code

- The amount of money you want to send

- Your own bank account details

Once you have provided this information, your bank will transfer the money to the recipient’s bank account. This method may take several days to complete and may involve fees.

- Online money transfer services: There are many online money transfer services that allow you to send money from Japan to India. Some popular options include Wise (formerly TransferWise), World Remit, InstaRem. To use these services, you will typically need to create an account, provide your personal and financial information, and enter the recipient’s information. You can then transfer the money using your bank account or credit/debit card. This method may be faster and more convenient than a bank transfer, but may also involve fees.

- Money transfer agents: Money transfer agents are companies that specialize in sending money from one country to another. Some popular options for sending money from Japan to India include Western Union and MoneyGram. To use these services, you will typically need to visit a local agent, provide your personal and financial information, and pay a fee. The agent will then transfer the money to the recipient, who can pick it up at a local agent in India.

Precautions to take while Transferring Money from Japan to India

When transferring money from Japan to India, it’s important to take certain precautions to ensure that the transfer is secure and that your money reaches the intended recipient. Here are some precautions to consider:

- Verify the recipient’s information: Before sending money, double-check the recipient’s information, such as their name, address, and bank account number. Errors in this information can result in delays or even loss of funds. If possible, ask the recipient to confirm their information to ensure accuracy.

- Choose a reputable service: Whether you’re using a bank transfer, online money transfer service, or money transfer agent, it’s important to choose a reputable provider. Look for providers with good reviews and a track record of successful transfers. Avoid providers that charge excessive fees or have a history of fraud.

- Be aware of fees: Depending on the service you use, there may be fees associated with transferring money from Japan to India. These fees can vary widely, so be sure to compare the costs of different services before choosing one.

- Use a secure connection: If you’re using an online money transfer service, be sure to use a secure connection to protect your personal and financial information. Look for a lock icon in the browser address bar to indicate that the connection is secure.

- Keep a record: Keep a record of your transfer, including the amount sent, the date, and the recipient’s information. This can help you track the progress of the transfer and resolve any issues that may arise.

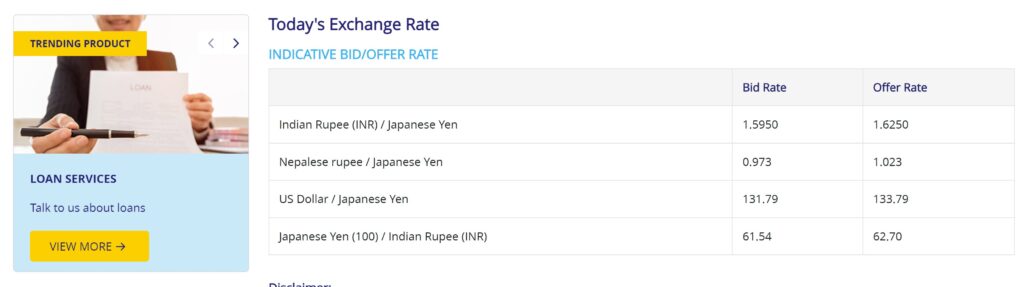

- Be aware of exchange rates: When transferring money from Japan to India, you’ll need to consider the exchange rate between the two currencies. Be sure to check the current exchange rate before sending money to ensure that you’re getting a fair rate.

Most Popular Options to send money from Japan to India

There are many companies that allow you to transfer money from Japan to India. Here are 10 of the most popular companies for international money transfers from Japan to India:

- Wise (formerly TransferWise): Wise is a popular online money transfer service that allows you to transfer money from Japan to India at competitive exchange rates and low fees. The service is fast and easy to use, and you can track your transfer online.

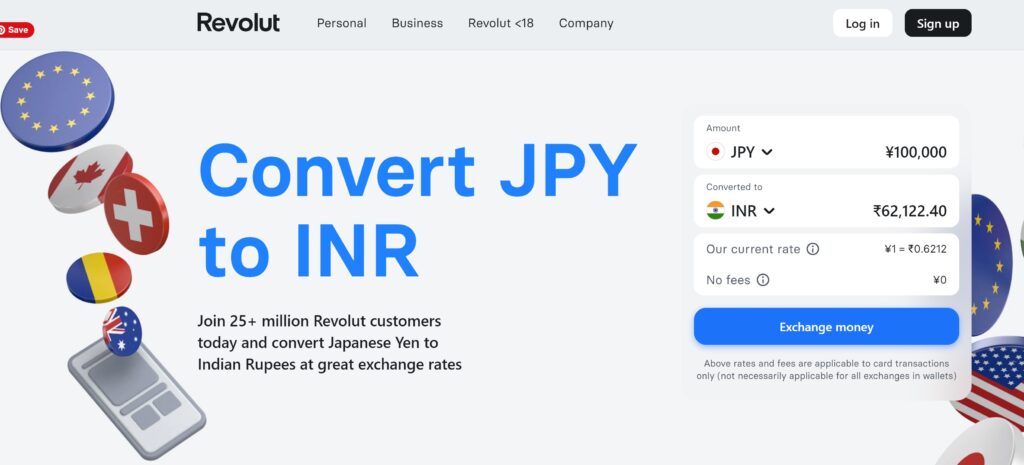

- Revolut: Revolut is a UK-based financial technology company that offers a range of digital banking services, including money transfer services. With Revolut, you can easily transfer money internationally to over 30 countries using the company’s mobile app.

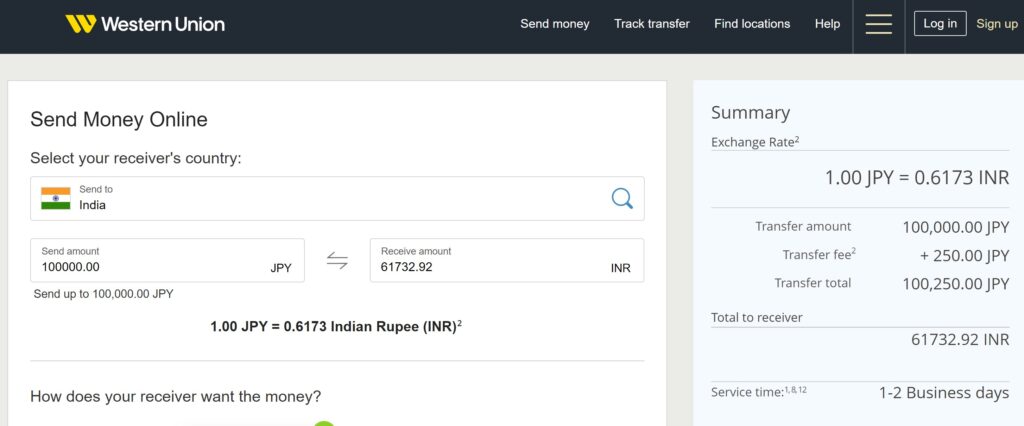

- Western Union: Western Union is a global money transfer company that allows you to transfer money from Japan to India. It offers a range of services, including bank transfers, cash pickups, and mobile wallet transfers.

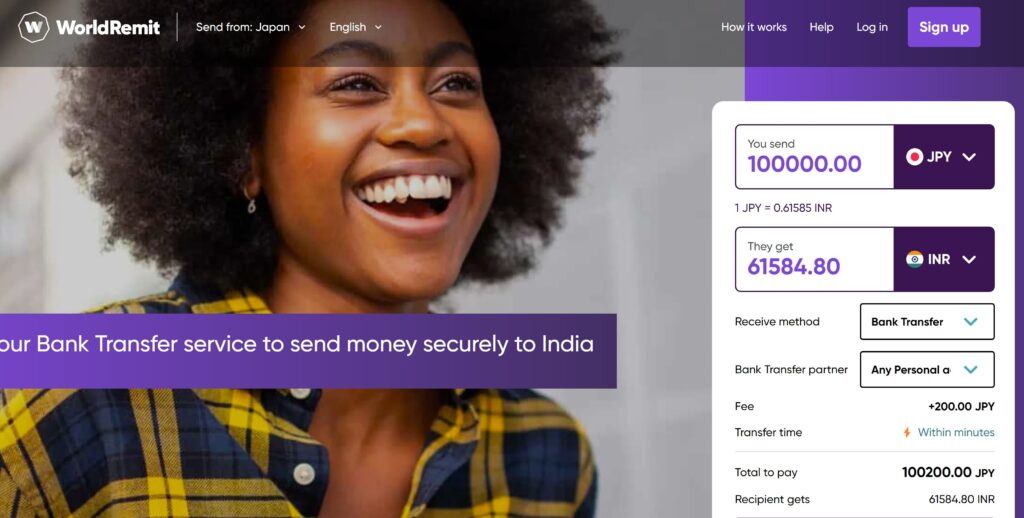

- WorldRemit: WorldRemit is an online money transfer service that allows you to transfer money from Japan to India. It offers competitive exchange rates and low fees, and allows you to track your transfer online.

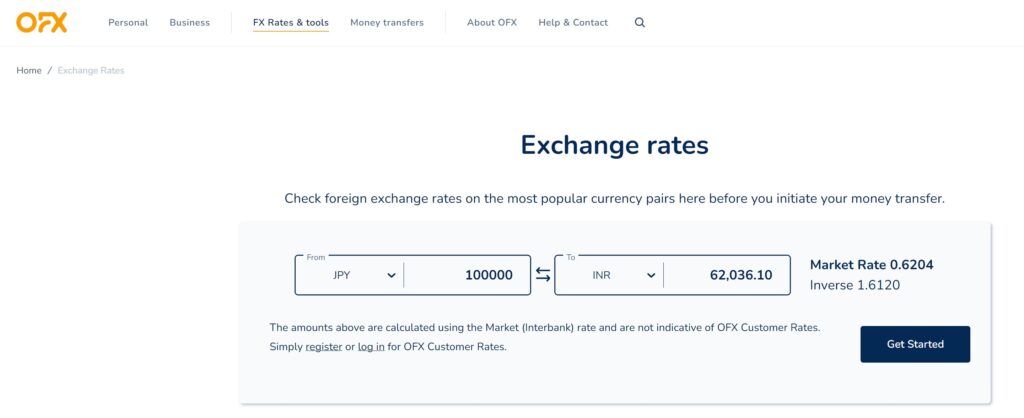

- OFX: OFX is an online money transfer service that allows you to transfer money from Japan to India at competitive exchange rates and low fees. The service is fast and easy to use, and you can track your transfer online.

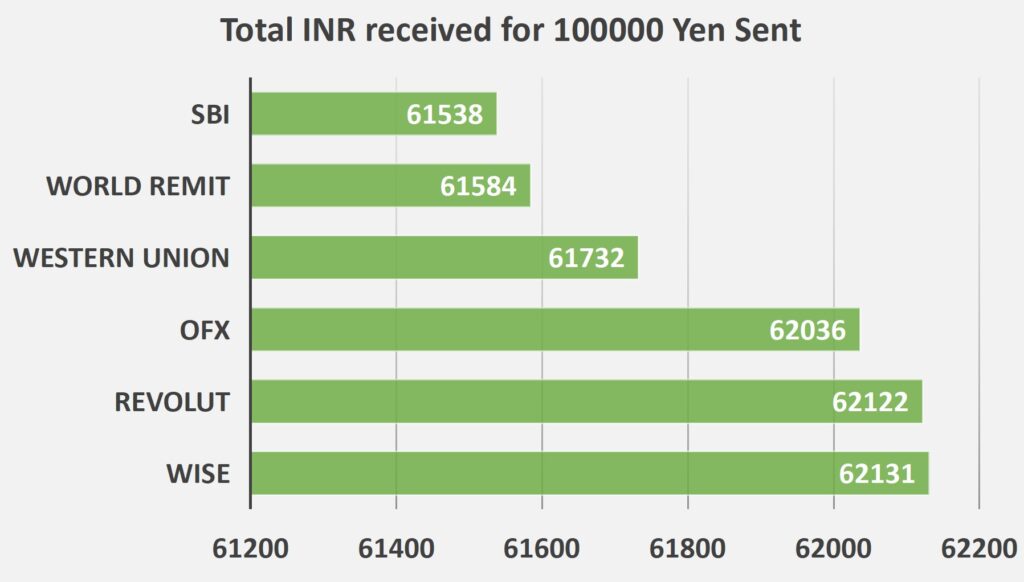

Comparing Option to Transfer Money

If you would send 100,000 Yen from Japan to India. Below is the amount of INR you would receive whiles using the various options.

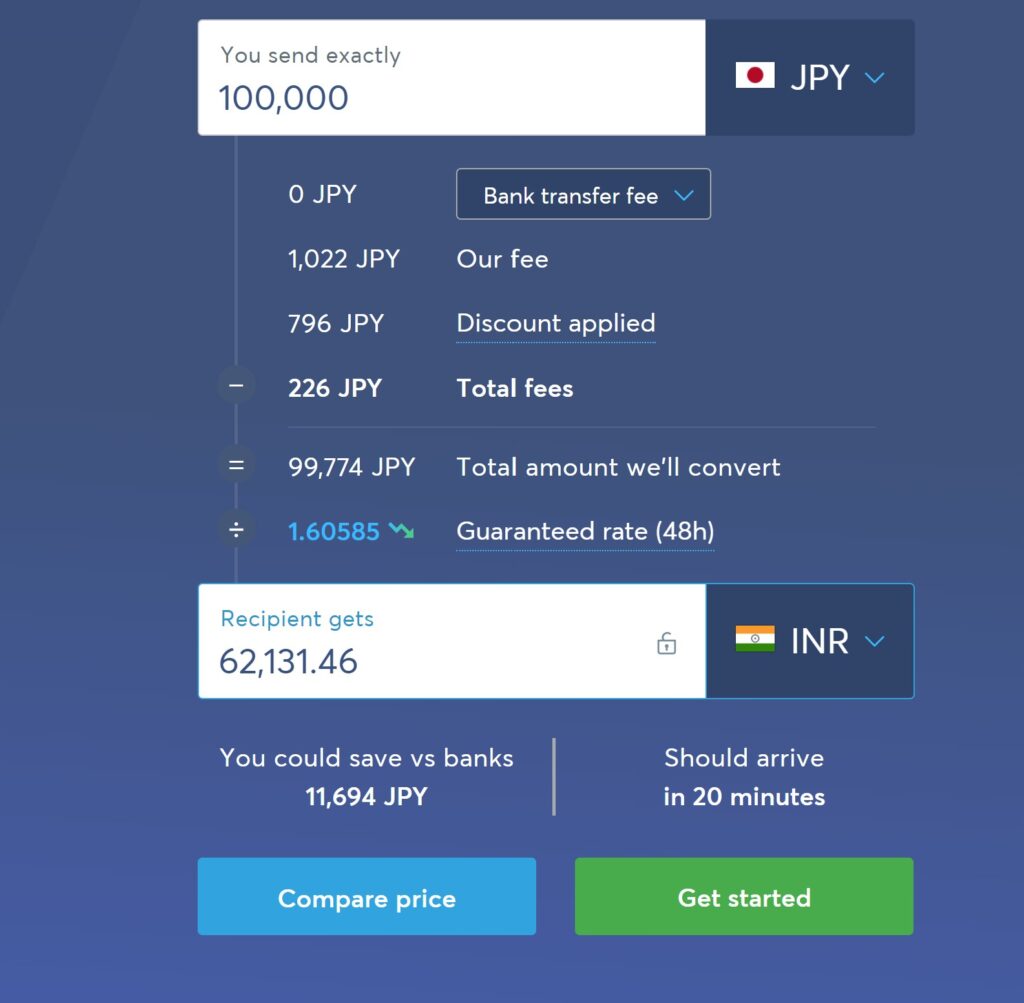

1. Wise – (Discounter Offer Link)

Wise provides one of the best experiences when sending money from Japan to India.

Here are some of the pros and cons of using Wise for your money transfers:

Pros:

- Competitive exchange rates: Wise offers competitive exchange rates that are typically better than those offered by traditional banks.

- Low fees: Wise charges a low, transparent fee for each transaction, and does not charge any hidden fees.

- Fast transfers: Wise transfers are usually completed within one to three business days, depending on the destination country and the payment method.

- Convenient: Wise’s online platform is easy to use and offers a variety of payment options, including bank transfers, credit and debit cards, and local payment methods.

- Secure: Wise uses advanced security measures to protect your personal and financial information, including 256-bit SSL encryption and two-factor authentication.

- Multi-currency accounts: Wise offers multi-currency accounts, which allow you to hold and exchange over 50 currencies at the real exchange rate.

Cons:

- Limited transfer options: Wise only allows you to transfer money between bank accounts, so you cannot use it for cash pickups or mobile wallet transfers.

2. Revolut

Revolut recently started in Japan and increasing its customer base.

When it comes to ensuring that the recipient of a bank transfer receives a guaranteed amount, Wise has an advantage over Revolut. This is because Wise offers local accounts for all their currencies, which they use to guarantee the exact amount that the recipient will receive. In contrast, Revolut may not have this capability, which could result in variations in the amount received by the recipient.

3. OFX

OFX is an Australian-based company that specializes in international money transfers. With the ability to transfer money in over 50 different currencies, OFX is a global business that provides a wide range of options for its customers. The name OFX is derived from the acronym for Open Financial Exchange.

OFX also provides a decent exchange rate compared to Wise and Revolut. But sometimes it takes a longer time to send money using OFX. Also, there is a minimum amount required when sending money from Japan to India.

Some of the notable features of OFX include

- Exceptional customer service

- No additional fees for transfers over $10,000

- Competitive rates for larger transfers

- Comprehensive mobile experience

Cons of OFX

- Minimum transfer amount

- Transfer fee for smaller amount

- They don’t accept credit card

- 24/7 support doesn’t extend to personal financial advice

4. Western Union

As a leading global money transfer service, Western Union offers individuals the convenience of transferring funds from anywhere in the world. With a vast network of over 101,000 branches in more than 185 countries, it is the largest institution for moving money on a global scale.

Advantages of Western Union

- Money Pick up Service Available

- Presence of offices and counters

Disadvantages

- Lower exchange rate

- Longer processing time

5. World Remit

WorldRemit is an online platform for transferring money to your loved ones anywhere in the world. This service offers a cheaper and faster alternative to traditional methods of money transfer, which often involve physically taking cash to post offices, agents, or banks, and incurring higher fees in the process.

With WorldRemit, you can send money quickly and easily from the comfort of your own home.

Advantages of World Remit

- Quick transfer time

- Cash Pick Up Available

Cons of World Remit

- Sign-up verification can take a longer time

- Transfer fee not fixed

6. SBI

State Bank of India (SBI) offers a wide range of options for international money transfers. With a large network of branches and correspondent banks around the world, SBI provides its customers with competitive exchange rates.

Advantages of choosing SBI

- Reliability of the banking giant (SBI)

- Hassle-free transfer from NRE/NRO account

Cons of SBI

- Lower exchange rate

- Need to visit bank to perform transfer

- Bad exchange rate compare to Wise, Revolut

Steps on Transferring Money Using Wise

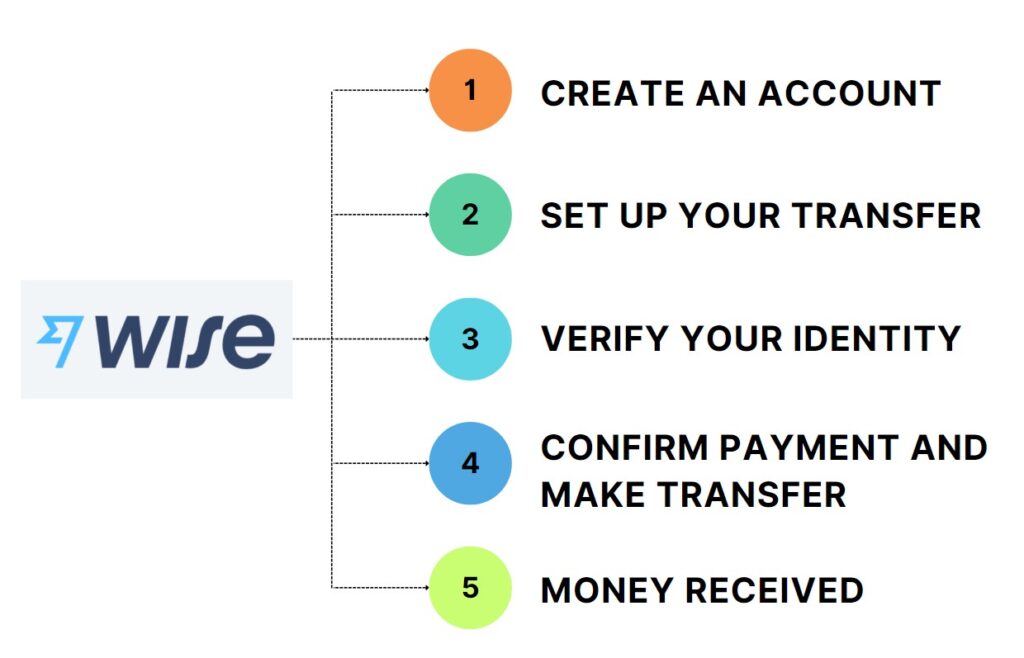

Transferring money using Wise is a simple and straightforward process. Here are the steps involved in making a transfer using Wise:

- Create an account: The first step is to create an account on the Wise website or mobile app. You will need to provide some personal information, such as your name, address, and date of birth, as well as your email address and phone number.

- Set up your transfer: Once you have created an account, you can start setting up your transfer. This involves entering the amount of money you want to send, selecting the currencies you are sending and receiving, and choosing the payment method.

- Verify your identity: In order to comply with financial regulations, Wise will need to verify your identity before you can complete the transfer. This may involve providing some additional information or documents, such as a copy of your passport or driver’s license.

- Confirm your transfer: Once your identity has been verified, you can confirm your transfer. This involves checking the details of the transfer, including the amount, currencies, and payment method, and then confirming that you want to go ahead with the transfer.

- Make your payment: The next step is to make your payment using the chosen payment method. This may involve transferring money from your bank account, using a debit or credit card, or using another payment option.

- Track your transfer: After you have made your payment, you can track the progress of your transfer using the Wise website or mobile app. You will be able to see the status of the transfer, including when it has been sent and when it has been received.

- Money received: Once the recipient has received the money, you will receive a notification from Wise. The recipient will receive the money in their chosen currency, which they can then withdraw to their bank account or use for other purposes.

Important Things To Consider While Transferring Money Internationally

When transferring money to India, there are a few things to consider to ensure that the transfer goes smoothly and efficiently. Here are some key factors to keep in mind:

- Exchange rates: It’s important to compare exchange rates from different money transfer providers to ensure that you get the best possible rate.

- Fees and charges: Different money transfer providers charge different fees for their services, so it’s important to compare these fees and find a provider that offers reasonable rates.

- Transfer speed: If you need to transfer money quickly, look for providers that offer fast transfer speeds.

- Security: It’s important to choose a reputable provider that uses secure systems and processes to protect your money and personal information.

- Customer support: Look for a provider that offers responsive and helpful customer support in case you need assistance with your transfer.

- Payment options: Check that the money transfer provider offers payment options that work for you, such as bank transfers or credit card payments.

- Limits and restrictions: Make sure you are aware of any limits or restrictions on the amount of money you can transfer, as well as any regulatory requirements for international money transfers.

- Exchange controls: Understand any foreign exchange controls or regulations that may impact your transfer.

- Local banking details: Make sure you have accurate banking details for the recipient, including the correct bank name, branch, account number, and routing code.

- Verification requirements: Be prepared to provide any necessary identification or verification information required by the money transfer provider or regulatory authorities.

RBI Guideline On International Money Transfer Limit

The Reserve Bank of India (RBI) has set certain limits on international money transfers to and from India. These limits are subject to change, so it’s important to check the latest guidelines before making any transfers. Here are some of the current limits for international money transfers to India:

- Individual remittance limit: The individual remittance limit for resident Indians is currently set at $250,000 per financial year. This limit applies to all types of remittances, including gifts, donations, and investments.

- Foreign portfolio investor (FPI) limit: The FPI limit for investment in Indian debt securities is currently set at $30 billion. This limit is subject to change depending on market conditions.

- Non-resident Indian (NRI) deposit limit: NRIs can deposit up to $1 million per financial year in a non-resident external (NRE) account or a foreign currency non-resident (FCNR) account.

- Outward remittance limit: The outward remittance limit for resident Indians is currently set at $250,000 per financial year. This limit applies to all types of remittances, including travel, education, and medical expenses.

FAQs on International Money Transfer

- What is the best way to transfer money to India from abroad? Answer: There are several ways to transfer money to India from abroad, including online money transfer companies, bank transfers, and remittance services. The best method may depend on various factors such as the amount of money to be transferred, transfer fees, exchange rates, and speed of transfer.

- What are the charges for international money transfer to India? Answer: The charges for international money transfer to India may vary depending on the service provider, the amount of money transferred, and the transfer method. Some service providers may charge a flat fee while others may charge a percentage of the transfer amount.

- What is the maximum amount that can be transferred to India from abroad? Answer: The maximum amount that can be transferred to India from abroad may vary depending on the service provider, the country of origin, and the purpose of the transfer. It is important to check the limits with the service provider before initiating the transfer.

- What are the documents required for international money transfer to India? Answer: The documents required for international money transfer to India may vary depending on the service provider and the purpose of the transfer. Generally, a valid ID proof such as a passport or Aadhaar card is required along with the recipient’s bank details.

- How long does it take for the money to reach the recipient in India? Answer: The time taken for the money to reach the recipient in India may vary depending on the service provider and the transfer method. Some service providers offer instant transfers while others may take a few days.

- What is the exchange rate for international money transfer to India? Answer: The exchange rate for international money transfer to India may vary depending on the service provider and the prevailing market conditions. It is important to compare the exchange rates offered by different service providers before initiating the transfer.

- Is it necessary to have an account in the recipient bank in India to receive international money transfer? Answer: It is not always necessary to have an account in the recipient bank in India to receive international money transfer. Some service providers offer cash pickup options or mobile wallet transfers that do not require a bank account.

- Is there any limit on the number of international money transfers that can be done in a year? Answer: Yes, RBI has a limit on how much an individual or a company can transfer from other countries to India.

- How do I track my international money transfer to India? Answer: Most service providers offer online tracking facilities that allow you to track the status of your international money transfer to India. You can also contact the service provider’s customer support team for assistance.

- What happens if the money transfer is not successful? Answer: If the money transfer is not successful, the service provider may refund the transfer amount or initiate a retransfer. It is important to contact the service provider’s customer support team for assistance in such cases.